Russia responded to sanctions by banning western food imports.

Supposedly the government hand picked products that should not

immediately harm Russian economy and consumer.

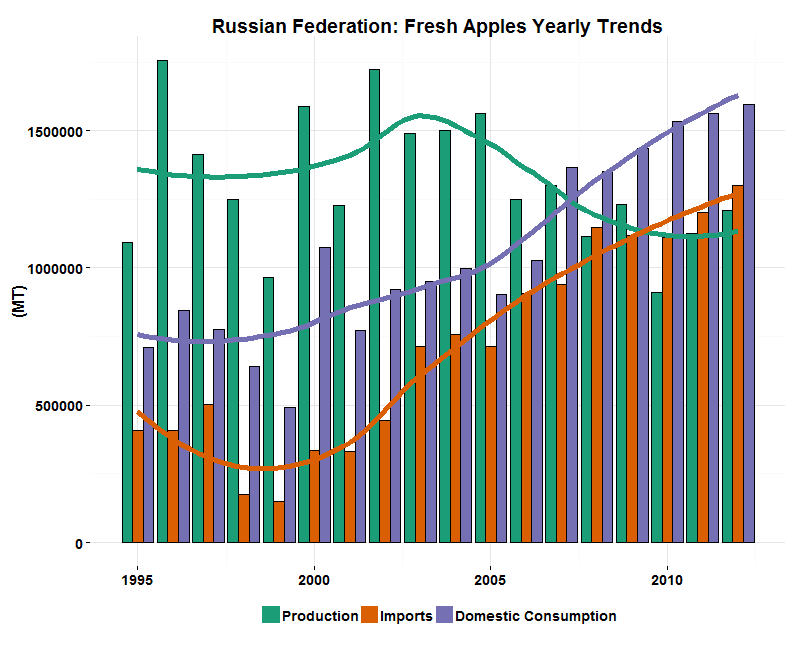

Big question in Russia is deciding between production

or replacing importers or both at least for one year while ban is active. Below I plot trends of Domestic Consumption, Production and

Imports by Russia for last 20 years or so for some of the banned food groups.

These are total numbers across all importers and my goal was to see when Russia can make leaps towards production and where it will likely

look for new import partners. I also hope that economists may find this information helpful to assess impact on Russian consumer and economy.

The Good

Chicken, pork, and turkey meats are doing great. For all 3, growing demand is met

with growing production and at expense of diminishing imports. Turkey industry in

Russia is simply experiencing Renaissance - too bad it's relatively

unpopular among consumers. All 3 are good choices to ban imports to further convince domestic producers to invest.

Fish and seafood demand is fully met by production, but picture is

distorted due to variability of products inside this food group. Probably, imports of

higher end products such as Norwegian salmon will not be easily replaced.

I suspect that Milk (non-dry) is not import

heavy product so there is nothing to worry about (on both

ends of the food ban vs. sanctions chain). We'll see quite different

picture with dry milk later.

The Bad

Everyone in Russia talks about beef from Brazil and Argentina nowdays and this chart clearly shows why. Both import and production trend lower with decreasing demand with import not very far below production. Russia will be looking for replacement of banned beef elsewhere, probably in Latin America.

All 4 dairy food groups above show clear sign of replacing production with imports in last 10-20 years with 2 Dry Milk groups at worst. Import trends go up despite stagnating demand. Russian producers of milk products and retailers will be looking for new importers unless the government will reverse trend in falling domestic production.

The Ugly

Fresh fruits will come from Turkey or China or somewhere but not from Russia. The only group that shows production growth is grapes but it's clearly too low.

I picked pistachios because almost everyone loves them and they were on the list of banned foods. Good luck to find them in Russian stores in a few weeks and my sincere sorry to high-end chefs who will miss them from appetizers to desserts.

The Cherry Orchard

Fresh Cherries (both sweet and sour) is a food group which associates with "The Cherry Orchard" - the last play by Anton Chekchov. You can read the play or look at the chart... and then read the play.

On more food groups and countries involved into Russia's Food Ban see my interactive infographics. Conclusions made are my subjective opinion. I welcome any comments and/or corrections.

Sources: Index Mundi and United States Department of Agriculture.

Hello Gregory,

ReplyDeleteThis is a great analysis, Dave and I discussed the possible results of the ban, regarding how quickly Russian entrepeneurs etc, can react to fill the gaps of banned imports. Growth in production of some items will help Russian economy and hurt the others. It is a mixed bag what the results long term will be, Too bad, the major countries of the world need to get along with each other, not go back to cold war nonsense.

Hope you and family are well, Jackie M

Hi, Jackie - great hearing from you and thank you for your feedback. In any case relacement will come at cost - more expensive, lower quality , more overhead, or capital investments into domestic production. The question is who will pay for all these and the answer is that almost certainly major part is on Russian citizens. Say hi to David!

Delete